Although this week’s major U.S. economic data and European Central Bank meeting contained more good news than bad for mortgage rates overall, rates ended slightly higher.

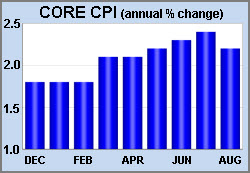

The most recent inflation data came in at lower than expected levels. The Consumer Price Index (CPI), a widely followed monthly inflation report that looks at the price change for goods and services, was just 2.2% higher than a year, down from an annual rate of increase of 2.4% last month. Lower inflation is positive for mortgage rates, but the reaction to the data was small.

The Retail Sales report released this week was mixed. Excluding the volatile auto component, retail sales in August rose just 0.3% from July, which was below the consensus for an increase of 0.5%. However, the July results were revised higher by an amount comparable in size to the August shortfall. As a result, the data was essentially neutral for mortgage rates.

Thursday’s European Central Bank (ECB) meeting produced no significant surprises and had little impact on U.S. mortgage rates. The ECB lowered its forecast for economic growth this year and next, but confirmed its plans to wind down its massive 2.5 trillion euro bond purchase program by the end of this year. ECB officials also said that they plan to hold the benchmark interest rate at current levels at least through the summer of 2019.

Looking ahead, the housing data will be the main focus. The NAHB home builder confidence index will be released on Tuesday. Housing Starts will come out on Wednesday. Existing Home Sales will be released on Thursday.

|

||||||||||||

|

||||||||||||

All material Copyright © Ress No. 1, LTD (DBA MBSQuotelin